OUR BLOG

Find the latest in trends, topics, and news about the finance industryHow to know if you need to file taxes

How to know if you need to file taxes 15 September, 2018 Finance Taxes Filing New to Texas and unsure if you need to file? Here is a brief explanation in which you would have to file for the year so you don't fall at fault. You do have to file taxes if you fall in...

When are taxes due?

FINANCE & LIFESTYLEWhen are Taxes due?Carlos Padron, Finance, Dallas, TX12 September 2018It is extremely crucial to know when your taxes are due especially if you haven't done so yet. Not knowing tax deadline dates can hurt you financially and your options may be...

The difference between Federal and State Income Tax

FINANCE & LIFESTYLEFederal & State Income Tax - Know the differenceCarlos Padron, Finance, Dallas, TX12 September, 2018 Avoid tax penalties when filing your return. A majority of taxpayers that move to a different state aren't fully aware of its state's tax laws...

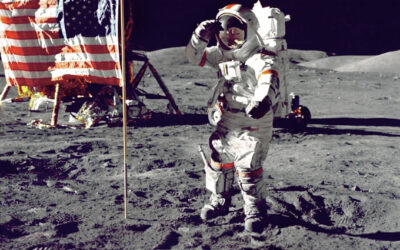

Veteran Information

Veteran Tax Information12SEPTEMBER, 2018Finance Taxes VeteransBeing a retired veteran has its tax and retirement benefits but knowing what exactly what is taxable and what is not taxable is a wealth of knowledge to understand and keep you from falling into a pithole....

Leveraging Joint Liability

Leveraging Joint Liability 11SEPTEMBER, 2018 Finance Taxes Injured Spouse Relief Form 8379 in its simplist form is filled out when you as a spouse need relief from being in a joint return. If you got divorced and need your share of the return to payoff past due...

How To File a 1040X

How to File a 1040X11 SEPTEMBER, 2018Finance Taxes 1040X A 1040X in its most simplest form is filled out if you made a mistake in your tax return that you already filed or came across some new information that could be applied to your already filed return. The IRS...