Our Blog News

How to know if you need to file taxes

How to know if you need to file taxes 15 September, 2018 Finance Taxes Filing New to Texas and unsure if you need to file? Here is a brief explanation in which you would have to file for the year so you don't fall at fault. You do have to file taxes if you fall in...

When are taxes due?

FINANCE & LIFESTYLEWhen are Taxes due?Carlos Padron, Finance, Dallas, TX12 September 2018It is extremely crucial to know when your taxes are due especially if you haven't done so yet. Not knowing tax deadline dates can hurt you financially and your options may be...

The difference between Federal and State Income Tax

FINANCE & LIFESTYLEFederal & State Income Tax - Know the differenceCarlos Padron, Finance, Dallas, TX12 September, 2018 Avoid tax penalties when filing your return. A majority of taxpayers that move to a different state aren't fully aware of its state's tax laws...

Veteran Information

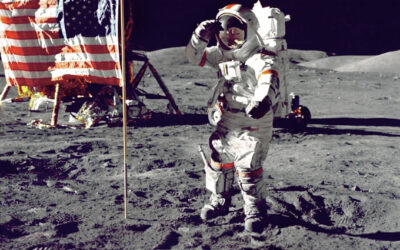

Veteran Tax Information12SEPTEMBER, 2018Finance Taxes VeteransBeing a retired veteran has its tax and retirement benefits but knowing what exactly what is taxable and what is not taxable is a wealth of knowledge to understand and keep you from falling into a pithole....

Leveraging Joint Liability

Leveraging Joint Liability 11SEPTEMBER, 2018 Finance Taxes Injured Spouse Relief Form 8379 in its simplist form is filled out when you as a spouse need relief from being in a joint return. If you got divorced and need your share of the return to payoff past due...

How To File a 1040X

How to File a 1040X11 SEPTEMBER, 2018Finance Taxes 1040X A 1040X in its most simplest form is filled out if you made a mistake in your tax return that you already filed or came across some new information that could be applied to your already filed return. The IRS...

Big Savings On Gas When You Travel

TRAVEL & LIFESTYLE Become A Travel Pro In One Easy Lesson Marco Pitt, Senior Travelers, Italy 22 March 2016 Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis...

Income Tax Questionaire

FINANCE & LIFESTYLENeed something to work with?Carlos Padron, Finance, Dallas, TX08 September 2018Having something to work with before seeing a tax professional can be beneficial and won't leave you paying so much to do your taxes.I'm a standard Image...

How to save your receipts like a Pro

h2>Debt

Part of being an effective leader of your small business is to be able to make sense of the numbers and to know that cash is king! Understanding debt is important because your business must be able to understand how to properly utilize debt as a tool that can help your business expand and grow.

As an entrepreneur, you will face two different types of debt to utilize as you you’re your business: personal debt and business debt. The reason for this is because often you are the first creditor for your business until your business grows to the point where it can get credit in its name.

In simple terms, debt is money owed from one person to another and it is not necessarily a bad thing. Debt can be a powerful tool to help a business grow. When properly utilized, debt can help a business benefit from leveraging the bank’s money in order to buy assets that will generate a profit. Unlike consumer debt which rarely allows a person to generate revenue, business debt can be a valuable tool because it allows a business to leverage other people’s money for the purpose of expanding. Some common uses of debt for your small business are to help fund operating costs or to purchase equipment or inventory.

Before getting debt, it is important for a small business owner to evaluate the true reason for why the debt is needed. If a business is having cash flow issues then obtaining new debt should be done only after a well thought out plan as to how the debt will improve the health of the business. Don’t make the mistake if your small business is having cash flow issues of taking on more debt that may not really fix the underlying financial situation. In this scenario, the business may be better suited to focusing on other ways to generate more revenue rather than on getting further into debt. On the other hand, the use of debt can be advantageous if the business is able to use the debt as a means to allow it to generate more revenue – such as by purchasing more inventory.

One way that a business can evaluate how effectively it is using debt is to calculate its debt ratio. The debt ratio is defined as the ratio of total – long-term and short-term – debt to total assets, expressed as a decimal or percentage. It can be interpreted as the proportion of a company’s assets that are financed by debt. The lower the debt ratio, the less leveraged the business is. Comparing your business’ debt ratio to those of your industry is one way of gauging where you stand among your peers.

Some ways that we can help an entrepreneur with business debt issues is by helping you to understand your financials and your ratios. Additionally, we can assist in restructuring business debts in the event that the current terms become unmanageable.